Home

Social Media Marketing Content and Tools That Get Results With Zero Effort

Increase

Social Media Posts

Increase

Website Traffic

Increase

Online Tool Usage

Increase

Engagement

Increase

Leads

Increase

Reputation

Experience the excellence of our real estate and mortgage company marketing services as we turn your dreams into reality. Powered by cutting-edge technology and our social media management expertise, we create a strong online presence, attract leads, and provide unparalleled service.

Blazingsocial specializes in crafting effective social media marketing content that drives engagement and maximizes your online presence. From our vast expertise in the mortgage and real estate industries, and deep understanding of social media platforms, we create compelling and visually appealing content that captures the attention of your target audience. From engaging posts to captivating videos, we’ll help you build a strong brand presence and generate leads through strategic social media marketing. Trust us to deliver impactful content that elevates your real estate and mortgage business to new heights.

BlazingSocial

All the Features You Need for Successful Social Media Marketing

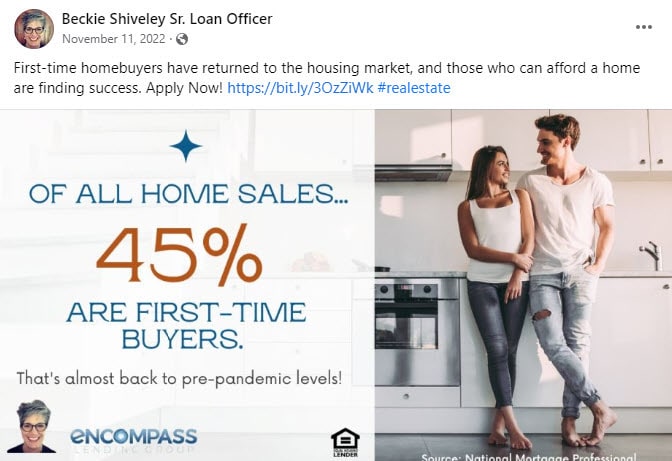

Professional Content

BlazingSocial posts professionally designed content to increase engagement and help you stand out.

Automation

BlazingSocial manages your social media by automatically posting our content, so you don’t have to.

Industry Specific

BlazingSocial industry-specific posts position you as an expert and enhances your reputation

Branding

BlazingSocial videos and infographic posts are branded with your information so you stand out from your competitors

Call-To-Action Links

BlazingSocial adds customized call to action links to increase website traffic and use of your online tools

Website Integration

BlazingSocial’s integration tool shows our videos on your website to add value and educate your visitors.

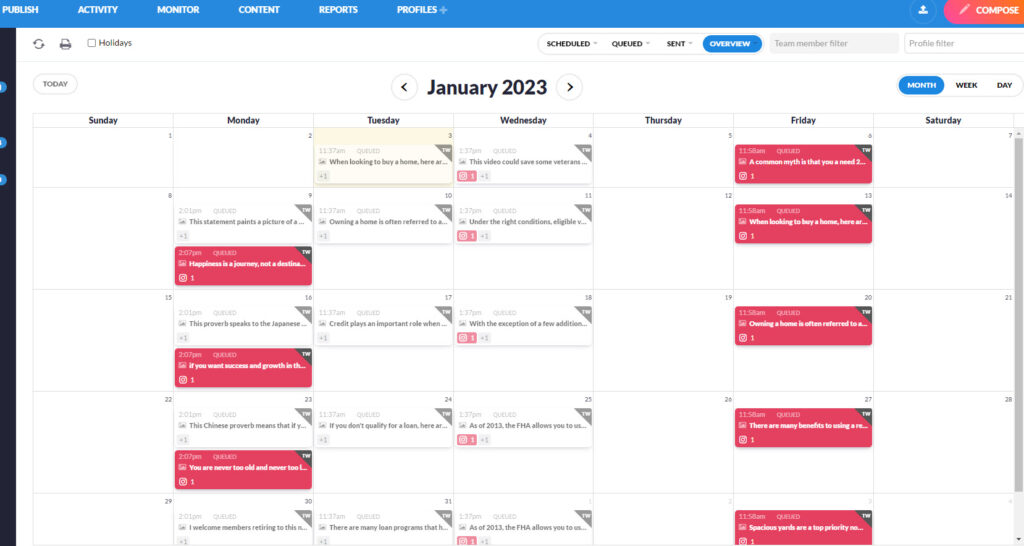

BlazingSocial + Sendible

Blazingsocial uses Sendible to manage and schedule posts to multiple social media networks.

With over 30,000 users Sendible is one of the best social media marketing tools available today.

Sendible has a variety of powerful features to help you grow your audience, attract new customers and reach your social media goals .

Don't Wait. Automate.

Outsource

Your Social Media Content Creation To Experts

Save Time

Focus On What You Do Best

Relax

Your Social Media Marketing Is On Autopilot