Mortgage

Made Easy For Loan Officers

Mortgage Social Media Marketing For Loan Originators

Social media can serve as a helpful tool for loan officers looking to generate new leads and increase sales. More people than ever are doing research online prior to selecting a loan provider. BlazingSocial can make sure you stand out.

BlazingSocial has all the content you need to represent your company as a reputable and trusted source, as well as an expert in your industry. You have to be able to engage with your clients in various ways today, and social media is one of the best ways to do so. Mixing in some non-industry specific content (think holidays and other occasions) with relevant and interesting industry-specific content will give your clients an extensive amount of knowledge and will keep them coming back for more.

Utilize the power of social media for mortgage brokers to amplify your business reach. Strategic content, targeted advertising, and tailored interactions will help you connect with your audience, build trust, and attract potential customers. Create an impressive profile online, engage with your audience, and advance your career in the mortgage business. Promote your mortgage brokerage, meet new people, and grow your business by utilizing social media platforms.

Mortgage Videos

It’s no secret that people prefer video for entertainment and information. This is especially true with social media marketing. Your results skyrocket with high quality and engaging video. Plus search engines favor video. Impress your followers with many different types of videos for first time home buyers, FHA, VA, reverse mortgage and more.

Mortgage videos are effective because:

- Grab your audience’s attention quickly

- Increase engagement on social media platforms

- Generates 1200% more shares than both images and text

- Branded with your photo, logo and contact information

- Increases traffic to your website

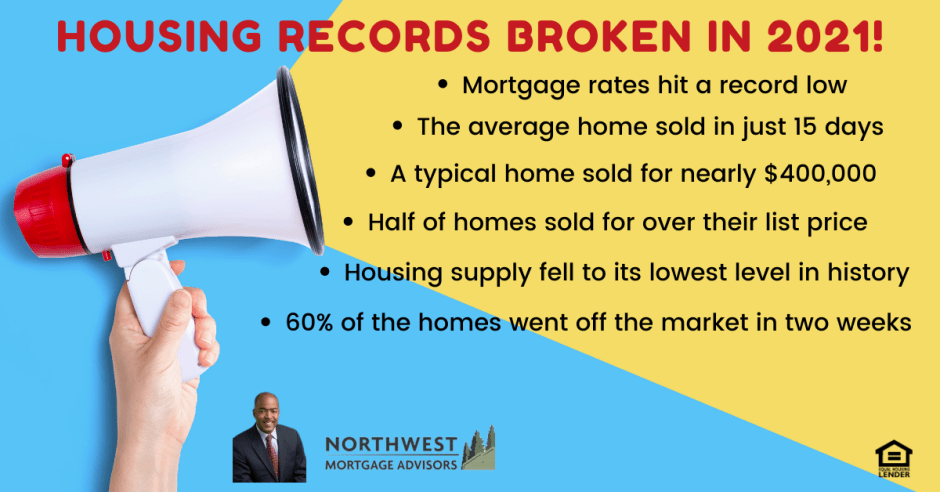

Economic, Real Estate and Mortgage News

The key to social media marketing is posting timely, relevant and engaging content consistently.

We create industry social media posts every week that you can post to your social media accounts. These posts enhance your professional image as an industry expert and thought leader.

If you want more followers, it’s important to be a source of useful information. Our weekly news posts give your visitors a reason to follow you.

BlazingSocial weekly industry news posts are effective because they:

- Connect with your audience

- Are branded with your photo and logo to stand out from competitors

- Drive traffic to your website with call to action links

- Position you as an industry expert

- Give your audience a reason to follow you

Inspirational Quotes

Inspirational quotes are an effective social media content strategy because they help build trust and connect with your audience on an emotional level.

BlazingSocial Quotes are effective because they:

- Are visual and easily consumed

- Arouse emotional responses

- Make branding simple

- Boost influence and authority

Holiday and Special Days

Holiday and special day posts are a great opportunity to make people feel good, connect to your brand and message and encourage people to like and share within their own online communities.

BlazingSocial holiday and special day posts are effective because they:

- Foster a sense of community

- Have an emotional appeal

- Are shared and liked

- Provide meaningful content variety

Increased sales

BlazingSocial helps you get better, trackable results with its ability to add customized Calls To Action (CTA) in social media posts. Calls to action will convert more business and get them to take the next step. Turn more prospects into clients with calls to action that get results. If you are currently using mobile apps and other online tools, BlazingSocial makes these tools more effective by giving your prospects and clients more opportunities to see and use these tools.

Examples of integrated services:

- Download My App (Cardtapp, Simplenexus, Loanszify)

- Let’s Get In Touch (Calendly)

- Visit My Website

- Apply Now (Online Application)

- How Much Can I Afford (Mortgage Calculators)

- How Much Is My Home Worth (Homebot)

The options are endless.

Marketing Departments

Turn hours into minutes when managing your social media clients. Plan ahead, directly schedule, collaborate, and report on your successes in one place.

Blazingsocial can be used to manage groups of loan officers from one central location. Easily manage multiple loan officers social media accounts from one platform. Create custom posts for one or all loan officers.

Turn hours into minutes when managing your social media clients. Plan ahead, directly schedule, collaborate, and report on your successes in one place.

Blazingsocial can be used to manage groups of loan officers from one central location. Easily manage multiple loan officers social media accounts from one platform. Create custom posts for one or all loan officers.